BitClout 2.0 — The Next Phase of DeSo • Decentralized Social

If you are unfamiliar with BitClout 1.0, we provide background in the next section, but you can also check out the one-pager here as well.

BitClout 2.0 is a new trading platform that introduces the following new products and features:

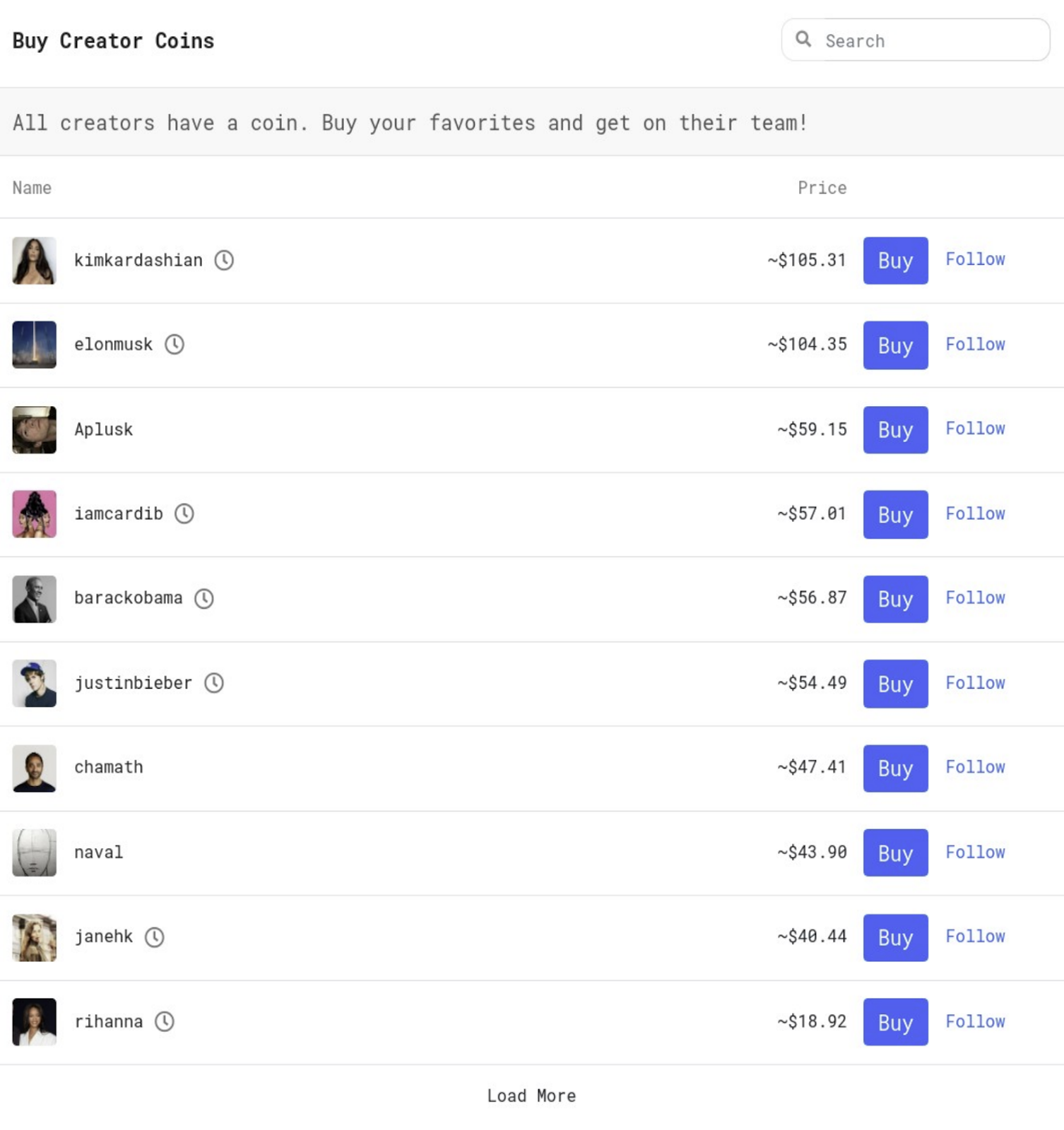

Creator Coins V2. A re-imagined version of the hit Creator Coins product, which launched with BitClout 1.0. Every profile on the platform can have its own coin that anybody can buy and sell. We call these coins Creator Coins, and you can have your own coin too simply by creating a profile and enabling it.

Creator Coins V2 solve all of the issues people had with the original bonding curve model by, among other things, transitioning Creator Coins to a fully-featured decentralized order-book exchange (The DeSo DEX).

Creator Coins V2 are fully backwards-compatible with existing V1 Creator Coins. All CCV1 coins will be transitioned over to CCV2 coins at launch, which will allow all CCV1 holders to earn $BITCLOUT rewards (more on this in the next bullets).

A New $BITCLOUT Coin. 1% of all CCV2 trading fees will accrue to a new $BITCLOUT coin.

Trading Incentives. BitClout 2.0 will distribute $BITCLOUT coins to incentivize trading and tight spreads, in order to build the critical mass of volume needed for the platform to become self-sustaining, and to maximize long-term trader retention.

Trading incentives will also aim to concentrate liquidity on the top coins, thus reducing the fragmentation of liquidity significantly, ensuring the top N assets are always getting enough action to be engaging and interesting.

$BITCLOUT distribution incentives will be perpetual, guaranteeing that the incentive to trade and to post remains long after the initial launch.

In order to claim trading rewards, traders must post once a day, improving content liquidity, not just asset liquidity.

All of this is something that BitClout 1.0 notably lacked, and something that we expect should significantly improve content liquidity and trader retention.

Creator Incentives. BitClout 2.0 will distribute $BITCLOUT coins to incentivize content from its top creators and their coin-holders, and to maximize long-term creator retention.

This will be done using a perpetual incentive that rewards coin-holders as well as creators when a top creator makes a post on a given day. This makes it so that creators' activity benefits their holders, in addition to themselves.

In order for a holder to be able to claim any $BITCLOUT rewards, both the creator and the user holding a creator's coin must have at least one post on the day the reward is to be distributed, further promoting content liquidity.

This is also something that BitClout 1.0 notably lacked, and something that we expect should significantly improve content liquidity and creator retention.

Decentralized Verification. A major issue with BitClout 1.0 was that verification of accounts was handled in a centralized fashion.

BitClout 2.0 will decentralize this process by allowing sufficiently high-clout accounts to verify other accounts, with all verification information stored directly on-chain.

In the event that a user verifies low-quality accounts, their verification chain can be invalidated by other high-clout users, thus protecting the integrity of the decentralized verification system.

We also expect that giving high-clout accounts the ability to verify other users will result in them forming a deeper connection with the platform.

Built on Decentralized Social. All profiles, all content including images and videos, and the entire social graph will be stored on the DeSo blockchain, meaning your social profile on BitClout 2.0 will be controlled solely by your private keys, just like you control your Bitcoin wallet.

This means that if BitClout 2.0 is successful, it will push us closer to a future where all of our content is truly owned by us.

A world where all of our content is stored directly on-chain, and controlled solely by our private keys, rather than the world we live in today where five megacorporations control the internet, and act as centralized digital banks for our most precious information.

Hundreds of people have provided us feedback on how we could have improved BitClout 1.0, from feedback on the Creator Coin bonding curve to thoughts on how to properly tie activity and cashflows to Creator Coin value.

BitClout 2.0 takes all of the amazing feedback that the BitClout community has given us since BitClout launched in March 2021, and aggregates it into nothing short of a truly breakthrough new product.

The beating heart of BitClout 2.0 is a re-imagined but backwards-compatible Creator Coin model that is years in the making, which we call Creator Coins V2.

Today, crypto is searching for its next big asset class. ICO's boomed in 2017, then the market graduated to NFTs in 2020.

Now, we think BitClout 2.0 has the potential to successfully turn reputation into a trade-able commodity for the first time, and to cement Creator Coins as the next major asset class for crypto, on-par with what NFTs are today.

BitClout 1.0: Pioneering a Stock Market for Reputation

In March of 2021, a mysterious password-protected link began to go viral.

The link allowed users to access a new app called BitClout, created by the pseudonymous founder known as @diamondhands. What started as just a white paper and an associated demo quickly evolved into an addictive worldwide phenomenon, thanks to BitClout's introduction of a novel new concept known as Creator Coins.

BitClout and its concept of Creator Coins was initially so viral and engaging that the early prototype alone attracted organic signups from hundreds of influencers and celebrities, and spawned numerous articles about its burgeoning "stock market for people," including a long-form piece in the New Yorker.

Top investors, including Sequoia, Andreessen Horowitz, and Social Capital backed the project, further enhancing its legitimacy, and at its peak, BitClout reached over 250 thousand monthly active users, many of whom still hold their Creator Coins to this day.

The concept of Creator Coins was inherently simple:

After creating a profile on BitClout, you could have a coin associated with that profile that anyone in the world could then buy and sell. As people would buy a coin, the price would go up, and as people would sell a coin the price would go down.

Simply put, BitClout pioneered the first truly mainstream stock market for reputation.

But there was something deeper that BitClout did: BitClout brought people together.

Many of its power-users report having the most fun of their lives meeting new people and reuniting with old friends over the trading of Creator Coins.

Among other things, BitClout spawned a parody boy-band called the BitClout Boys, hundreds of alternative apps built off of its infrastructure, and it even resulted in dozens of people getting BitClout Tattoos (yes, that's a real picture).

Many people reported losing weeks of sleep obsessively strategizing with friends on what posts and trades to make each day, many people report buying their first Bitcoin in order to be able to trade Creator Coins with their friends, and many of the group chats that formed around BitClout are still going strong today.

So what happened?

Ultimately, while BitClout was incredibly viral, it lacked retention.

Clearly, the concept of being able to trade reputation as an asset class was very appealing at its core, but BitClout's execution was lacking to say the least.

As a result, BitClout's user-base eventually dwindled, and, although many users held onto their Creator Coins, the hype and excitement ultimately faded.

Until today...

Building With the Community

Although BitClout 1.0 was not ultimately retentive, it did have one tremendously valuable thing: A strong and engaged community that was more than willing to provide feedback on everything that was and wasn't working in real time.

While BitClout 1.0 was launched by an isolated team making guesses in the dark as to what users would want, BitClout 2.0 will be nothing short of a community effort, aggregating hundreds of lessons from thousands of users, and integrating them starting at the design stage (i.e. right now).

In this section, we attempt to aggregate the key takeaways from hundreds of conversations with BitClout users on what needed improvement.

That being said, if there is anything that you think we're missing, we strongly encourage you to leave a comment on this post here, which we're using to aggregate everyone's latest raw thoughts in real time.

With the above being said, below are some of the core issues that we think held BitClout back from being Crypto's Next Platform:

The Creator Coin "bonding curve".

Unlike traditional assets like stocks that trade on order-book exchanges, Creator Coins were "locked" to a bonding curve, meaning price increases and decreases were determined solely by a formula.

While this provided a relatively simple user experience (UX) for early adopters, it quickly became clear that such a mechanism would not scale to support Creator Coins as a true asset class.

Among other issues, many gave feedback that the bonding curve was too steep, meaning that price increases happen too quickly at the beginning. This results in those who buy a coin early possessing too much of an advantage over those who buy later on.

In order for Creator coins to scale to a true asset class, powering a true stock market for people, it quickly became clear that the bonding curve approach would need to be re-imagined entirely.

No reason to hold a Creator Coin.

Although Creator Coins were initially intended to be a proxy for reputation, it became clear that people wanted more out of holding a Creator Coin than just the ability to sell it at a later date.

A real source of cashflows directed at Creator Coins, potentially derived from creators' and traders' activity on the platform itself, would have provided much more incentive to actually hold a creator's coin longer-term.

Unfortunately, this was difficult to execute with the bonding curve model in-place, and so Creator Coins became solely objects of speculation, which was ultimately not retentive.

No incentive to be active.

Early on, many suspected that there would be a link between a creator's level of activity on BitClout and the value of their Creator Coin. Unfortunately, because there was no direct tie-in here, Creator Coin values detached from activity, thus resulting in very little incentive for a creator to actually post and engage on BitClout.

If a Creator Coin's value could have been at least partially tied to how active a creator was on BitClout, that would likely have resulted in a much more robust market for Creator Coins early on, and a potential positive feedback loop for the BitClout platform as a whole.

Creators could not sell their own coin.

Partially because of the bonding curve mechanic, and partially because Creator Coins had no inherent cashflows, creators who held a significant portion of their own coin did not feel like they could sell their coins.

In particular, a creator selling their Creator Coin would often be seen as "dumping" on their biggest fans. This resulted in many creators feeling like the income they had earned wasn't real, in some sense.

Attaching a cashflow to Creator Coins or detaching a creator's income from their Creator Coin holdings entirely likely would have solved this issue.

Lack of trading tools.

It is frankly shocking that Creator Coins became as popular as they did without any trading tools available on BitClout. Even something as simple as historical prices for Creator Coins was unavailable, thus further hampering Creator Coins' ability to graduate into a true asset class.

What would have become of BitClout and Creator Coins if all of the above issues were resolved prior to BitClout launching?

Of course, it's difficult to say for sure, but most of the community members we've talked to believe BitClout would have had a much better chance of retaining users and traders if these issues were resolved.

Catching Up On Creator Coins V1

The original Creator Coin mechanic that launched with BitClout 1.0, which we'll refer to as Creator Coins V1, was both a novel breakthrough and yet hopelessly flawed.

While many will express their dissatisfaction with creator coins differently, we believe the root of all of the issues comes down to the bonding curve mechanic backing all V1 Creator Coins.

In particular, the price of each Creator Coin increases and decreases algorithmically according to a fixed formula we'll discuss shortly.

The nice thing about this mechanism is that you don't need to know anything about the math underlying it in order to be able to buy and sell Creator Coins.

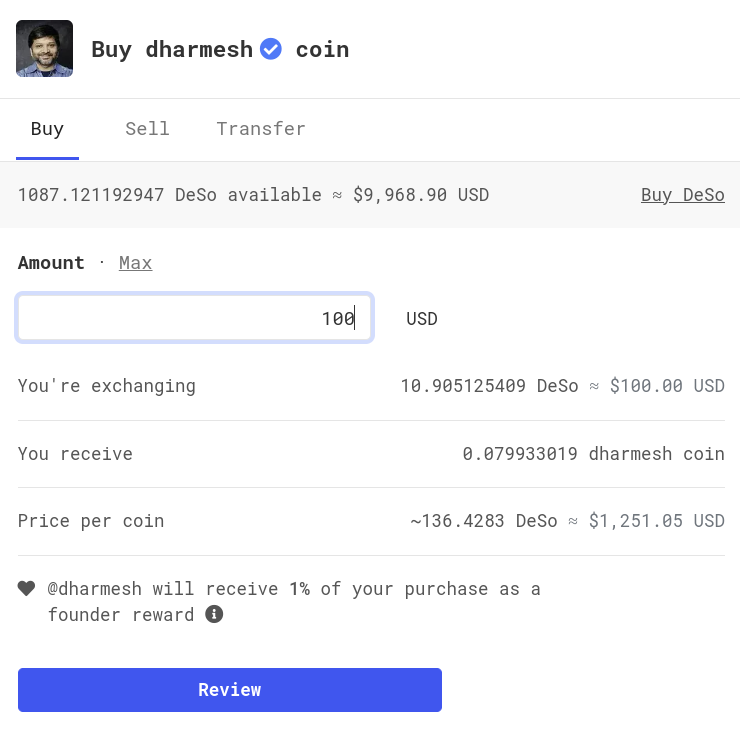

You can just enter the amount of a person's coin that you want to buy, and the formulas will give you a price per coin, as shown in the example below.

Under the hood, when you buy a Creator Coin, funds get locked in the profile, coins get minted and given to you, and the price goes up (according to the formula).

When you sell a Creator Coin, funds get unlocked from the profile, your Creator Coins get burned, and the price goes down (again according to the formula).

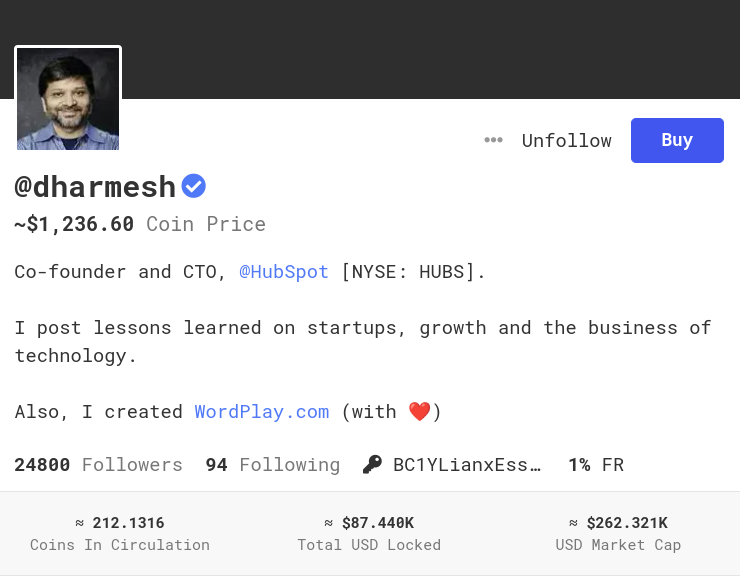

As such, you can compute the price of any Creator Coin by computing the amount of funds locked inside its profile, and plugging that amount into the formula.

In particular, the price of each Creator Coin increases and decreases algorithmically according to the fixed formula shown below:

creator_coin_price_in_USD = .003 \* creator_coins_in_circulation^2

Integrating this formula, which we'll omit the steps for here, allows us to compute the number of Creator Coins in circulation as a function of how much money is locked in the profile:

creator_coins_in_circulation = (-((-USD_locked_in_profile)/(.003\*(1/3))))^(1/3)

Using these two formulas, BitClout could power a very simple UI attached to a user's profile that showed that profile's coin price, coins in circulation, the total USD locked, and the market cap of the coin, as shown in the following example (note that the coin price is shown under the username while the other info is shown at the bottom):

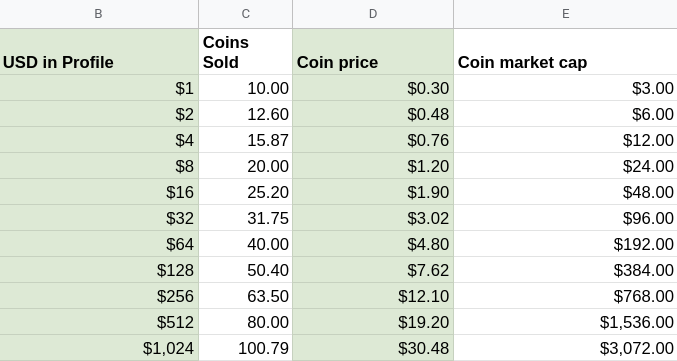

To go a bit deeper, the formulas can also be used to produce a relatively straightforward table that tells you what the price of each creator is as a function of how much has gone toward purchasing their coin. You can play with these numbers in this spreadsheet here (make a copy to edit values):

The Core Problem With Creator Coins V1

To understand why V1 Creator Coins are flawed, it's useful to consider how trading V1 Creator Coins differs from trading a token listed on an order-book exchange like Coinbase or Openfund.

With Creator Coins V1, you can only buy or sell. You cannot express a desire to buy or sell at a particular price.

For example, if you felt like a coin would be under-valued at a price of $5, you would not actually be able to express that opinion with Creator Coins V1.

Instead, you would have to wait for it to actually reach that price, and then hope that there is someone willing to sell you coins for that price at the time when you're online.

This is bad because it then requires every large transfer of coins to first dump the price significantly when the seller sells their coins, and then immediately spike the price when the buyer comes in to take the second half of the trade.

Put another way, V1 Creator Coins have no way of storing liquidity the way order-book exchanges do.

The only people who can take the other side of your trade are people who are online at the time you want to buy or sell, and the only way to communicate your intent with them is to massively dump or spike the price of the coin you want to trade on.

Every sell feels like you're dumping on someone, rather than matching with them. In contrast, with an order-book exchange, every coin can have limit orders at various prices set from dozens of market-makers, thus resulting in thick demand at each price level.

This then yields the ability to do very large volumes without significantly dumping or spiking the price.

The above insight is described in many different ways by people in the community. Some people describe an elusive predatory feeling when buying or selling a V1 Creator Coin. Others describe the problem as the bonding curve being too steep.

But ultimately, all of these criticisms are symptoms of the same root issue, which is the inability to express a limit order, and therefore an inability for the coins to accumulate liquidity over time.

Frankly, when considering how limited V1 Creator Coins are when compared to an order-book model, it is a bit surprising that they managed to become as popular as they did. As such, it's potentially the strongest evidence that a properly-implemented version of Creator Coins that doesn't have these issues could do very well.

Creator Coins V2

Creator Coins V2 are the beating heart of BitClout 2.0, and in designing them we wanted to take everything people loved about V1 Creator Coins, and re-imagine everything that held them back.

We wanted to fix all of the issues the bonding curve created, but in a fully backwards-compatible way. Put simply, we wanted to design both a better model for Creator Coins and a way to migrate pre-existing Creator Coins to this new model.

What's more, we wanted everything about this new model to be something that pre-existing Creator Coin holders would be excited about.

As such, we'll start by explaining our new model for V2 Creator Coins, and then we'll talk about how pre-existing V1 Creator Coins can be migrated into V2 Creator Coins.

From Bonding Curves to Order Books

The thing that V1 Creator Coins really nailed was the concept of an automated market-maker, which is effectively what the bonding curve provides.

For any coin that anyone launches, there is always a price that someone can buy and sell for at any given time.

This creates a magical experience for users because it makes it so that even the very long tail of profiles can always be traded by anyone.

The main issue with the bonding curve is that it is the only market-maker in the sense that nobody can express a desire to buy and sell that's independent of it.

Put another way, imagine an order-book exchange where only a single market participant is allowed to create orders, and everyone else is only allowed to match with the orders of this single market participant.

That would obviously be a much more limited experience than if everyone were able to specify their own limit orders independent of this market participant.

And yet the very limited single-market-participant scenario we're describing is almost precisely what V1 Creator Coins are restricted to.

As such, what you really want is to express the bonding curve as a series of limit orders on an order-book, and then to allow anyone else to supplement the order-book with their own orders.

Such a scheme would achieve the best of both worlds:

It would provide all of the advantages of a traditional order-book, allowing anyone to submit limit orders at any price, thus solving the steepness concerns associated with the pure bonding curve approach.

In addition to this, such a scheme would provide at least as much liquidity as the pure bonding curve approach because users' orders still have the option, but not the obligation, of hitting the bonding curve if it's offering the best price.

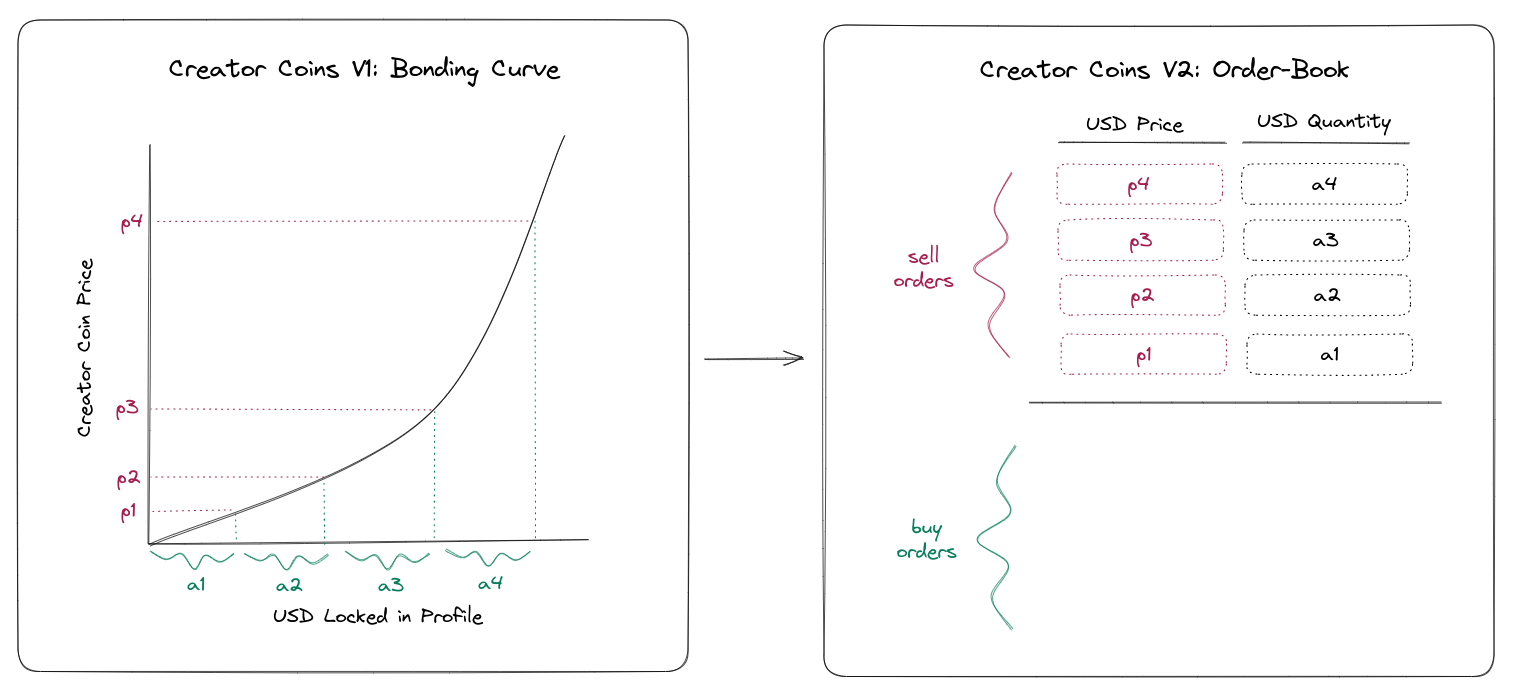

Given the above, all that's really needed to implement Creator Coins V2 is to translate the V1 bonding curve into a series of limit orders, and then to place these limit orders on an order-book exchange.

The DeSo blockchain provides all of the infrastructure out-of-the-box to power all of BitClout 2.0's order-book functionality, without the need to even write any smart contracts.

And so all we really need to do is establish a series of limit orders, representing the bonding curve, that will be placed when a V2 Creator Coin is initialized.

Translating a Continuous Bonding Curve Into Discrete Limit Orders

The existing bonding curve powering V1 Creator Coins is continuous, but order-books are discrete in the sense that they represent a finite number of orders.

As such, to translate a V1 Creator Coin bonding curve into a series of limit orders, we need to roll up each section of the Creator Coin curve into a single limit order represented by an average price and a number of coins to sell.

Visually, this translation looks something like the following graphic. Notice that the curve is being broken up into chunks and then expressed as a series of discrete limit orders.

Importantly, the orders are not managed by the creator but rather by an automated market-maker that is responsible for automatically creating them when a profile is created, and then automatically managing them as people buy and sell the coin.

Moreover, the process by which the automated market-maker places orders is intended to exactly emulate the behavior of the original bonding curve.

This is best illustrated with an example:

Suppose someone creates a profile, and decides to initialize their V2 Creator Coin. This would result in the series of limit orders shown in the previous graphic.

In particular, the order-book would consist of a bunch of sell orders but no buy orders.

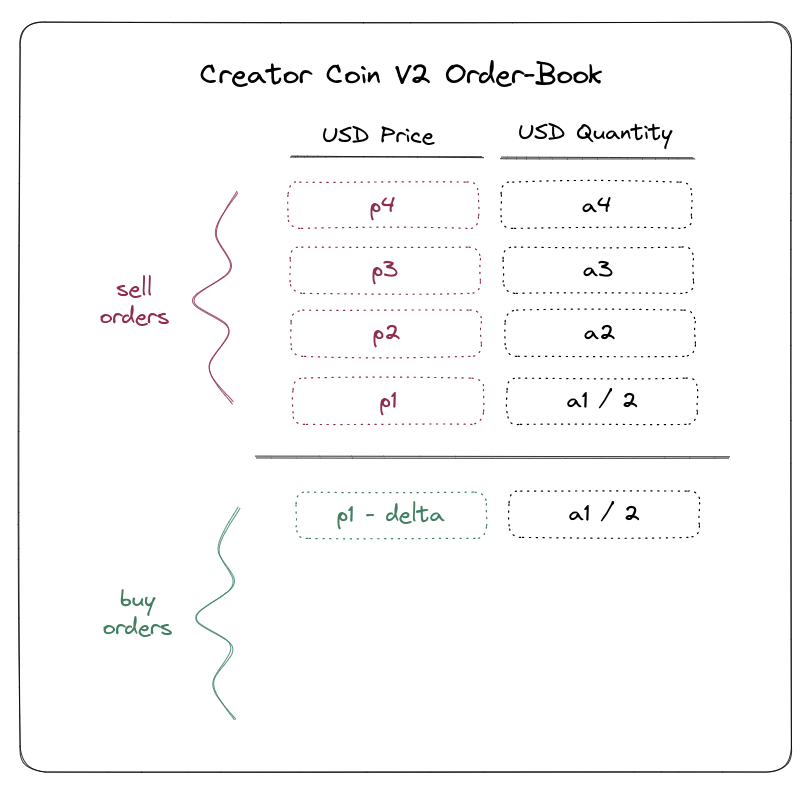

Now, suppose someone comes in and wants to buy some of this user's V2 Creator Coin.

They can place a market order, which would simply match against the lowest sell order, or they can place a limit order, which would allow them to express that they want to buy coins at a particular price, rather than whatever the market will give them. Obviously, if this user places a limit buy order that is below p1, then that order will simply sit on the buy side of the market.

What's more interesting is if they match against the automated market-maker's orders (let's call it the AMM for short).

In this latter case, the AMM would fill the user's order, and then also create a limit buy order for the exact amount that was filled.

The example below shows that the order-book would show if the user placed a market-order to purchase (a1 / 2) coins (that's half of a1). Notice that the AMM immediately places an order to buy back the coins it just sold for a slight discount (which we show as delta in the graphic).

As long as the AMM always places orders to buy coins that it sells to users, as described above, it should effectively act as a discrete emulation of the V1 Creator Coin bonding curve.

The upside, however, is that users can add their own liquidity to the order-book at any level, including levels between the AMM's orders.

This effectively solves the curve steepness issue referenced by most users.

The Math (Optional)

The beauty of Creator Coins V2 is that one does not need to know anything about the math in order to be able to trade.

One can simply take a look at an order book and place their orders according to the liquidity that's on that particular market.

This being said, we go into a little more detail on the math in this section.

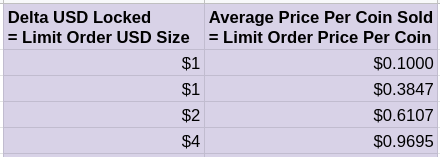

There are many ways to convert the V1 Creator Coin curve into a discrete set of limit orders. The main decision is how you go about chunking the curve into pieces.

This sheet here shows one way of doing it, whereby each limit order doubles in USD size. We copy a snippet of this sheet below, though it is useful to inspect the entire sheet and play with it (make a copy to edit it).

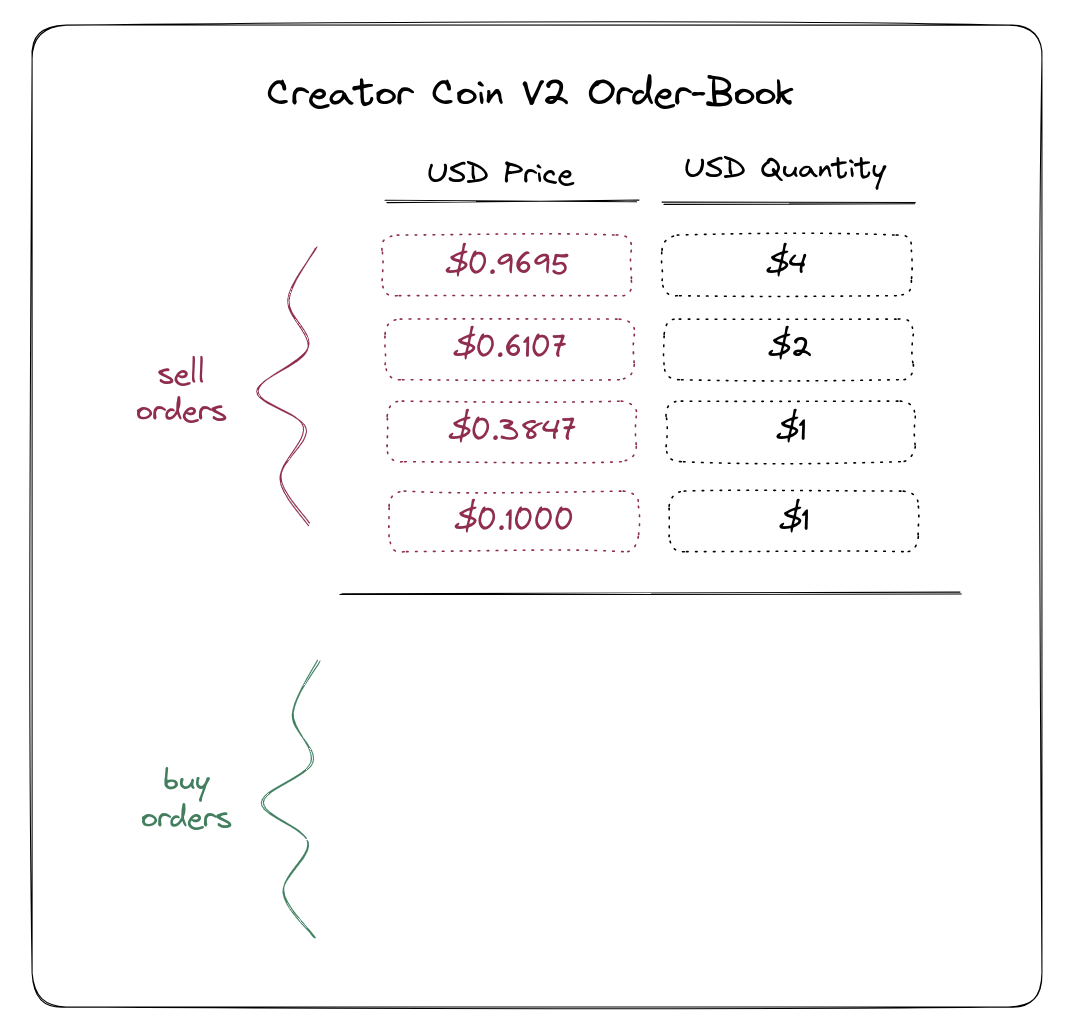

If we went with the translation expressed in that sheet, then we can fill in some concrete values for our graphic from earlier.

Note, however, that there would be many more orders at higher prices that we aren't showing in this graphic.

Fixed-Supply Creator Coins

The astute reader will notice that, if Creator Coins are migrated into an order-book model, then the discrete bonding curve imposed by the AMM effectively represents infinite sell pressure because it offers a sell order at prices going up to infinity.

This isn't really a problem with V2 Creator Coins, it's a problem that always existed with V1 Creator Coins that now exists in V2 only because we translated the bonding curve over directly.

Interestingly, however, because they leverage an order-book model, V2 Creator Coins can solve this problem by allowing creators to fix the supply of their coins after a certain point.

Remember that the bonding curve, which we will now refer to as an AMM in V2 Creator Coins, is really only needed for bootstrapping liquidity for a creator's coin.

After there's a lot of interest in someone's coin, there is really no need to have an AMM anymore because market participants should be able to provide plenty of liquidity on their own.

Running with the above, BitClout 2.0 can very easily support a button creators can push that turns off the AMM, thus fixing the supply of their coin.

This means that all of the buy orders from the AMM remain, but all the sell orders disappear, thus allowing the Creator Coin price to rise, free of the sell pressure of the AMM.

There are many ways to go about implementing this feature, but we propose a few alternatives that we'd like your feedback on below:

Creator-discretion. The first option is to simply allow creators to fix the supply of their coin at their discretion. In other words, the AMM will turn off its sell orders only when the creator decides they want it to.

Set threshold. The AMM can be configured to only go up to a pre-determined threshold, say a price of $100 (meaning the AMM has processed $1,000 in buy orders according to the sheet). The logic behind this would be that any coin that has managed to accumulate $1,000 in buys probably has enough other market participants interested in it that it doesn't need the AMM to provide liquidity for it anymore.

Creator-driven threshold. Upon launching their coin, a creator could specify what threshold they want the AMM to process orders up to. Generally, we prefer to keep things as simple as possible for creators, but we provide this option for completeness.

Having discussed the possibility of coins becoming fixed-supply after they have enough organic interest, we are well setup to discuss migrating pre-existing V1 Creator Coins...

Migrating V1 Creator Coins

Today, there are millions of dollars locked in V1 Creator Coins like $WhaleSharkETH, $chamath, and of course $elonmusk, and no V2 Creator Coin scheme would be complete without an exciting migration plan for all of the early adopters who maintained their holdings through all of the ups and downs.

Perhaps surprisingly, migrating V1 Creator Coins into V2 Creator Coins is relatively straightforward.

All that's needed is to take the funds currently locked in each profile, and use those funds to back bid orders via the AMM scheme described previously.

Put another way, pre-existing V1 Creator Coins will become virtually identical to V2 Creator Coins that have an equal amount of coins sold by their AMMs.

Creators who control their coins can then opt to fix the supply if they wish, and start submitting orders as well.

There is one interesting decision, which is what we should do with regard to fixing the supply of unclaimed coins that we migrate from V1 to V2.

For example, in the case of coins like $elonmusk that have a lot of holders, it could make sense to simply fix the supply upon migrating, thus reducing downward pressure on the price. We are open to feedback on what to do with unclaimed accounts, so feel free to let us know what you think.

Eliminating Founder Reward

As we will discuss later on when we talk about incentivizing activity on BitClout 2.0, V2 Creator Coins will no longer have a concept of Founder Reward like BitClout 1.0 had. Instead, creators will be compensated directly for their activity.

This ensures that we're keeping everything as simple as possible.

Turning Off the AMM

In the event that a creator has fixed the supply of their coin and that creator's coin price has detached significantly from the buy orders submitted by their AMM, it could make sense to give the creator the option to cancel all of the AMM's buy orders and take the funds backing the AMM for themselves.

This could provide a significant incentive for creators to fix the supply of their coin, and to get their liquidity up to a point where it no longer needs the AMM.

Such a feature would need to be considered very deeply before being added as an option, as there are many ways in which creators could abuse such a power.

But luckily it is something that can be added later on, without requiring a decision prior to launching the BitClout 2.0 platform.

The New $BITCLOUT Coin

With the launch of BitClout 2.0, we are excited to introduce a new token that will be used to incentivize engagement early on in clever ways that should radically improve retention when compared to BitClout 1.0. We will be calling this token simply $BITCLOUT.

Apps like Compound, Sushiswap and, more recently, Blur all show that using a token to incentivize adoption early on can be an amazing crypto-native way to solve the cold-start problem, especially when it comes to bootstrapping a trading platform.

In particular, Compound distributed tokens to incentivize staking assets as collateral for lending, effectively inventing the concept yield farming, and Sushiswap distributed tokens to incentivize trading on their DEX, stealing market share from Uniswap, who was then forced to respond by implementing their own token incentive scheme.

More recently, though, Blur rocked the crypto world by using clever token incentives to take a significant amount of liquidity from OpenSea with a scheme that is directly applicable to the launch of Creator Coins V2 (also, did we mention we love their website's aesthetic?).

The scheme to start is relatively simple at a high level:

BitClout 2.0 charges a 1% fee on every trade, which can be adjusted at any time, e.g. by a community vote.

While there are many ways for a new coin to capture value on the BitClout 2.0 platform, we believe the simplest by far initially is to charge a fee on the trading of Creator Coins V2.

In particular, while other sources of revenue can be added later on, such as subscription content, our experience with BitClout 1.0 seems to indicate that a fee on trading is likely to far exceed other sources at the beginning.

100% of all fees will go to holders of $BITCLOUT in proportion to their holdings.

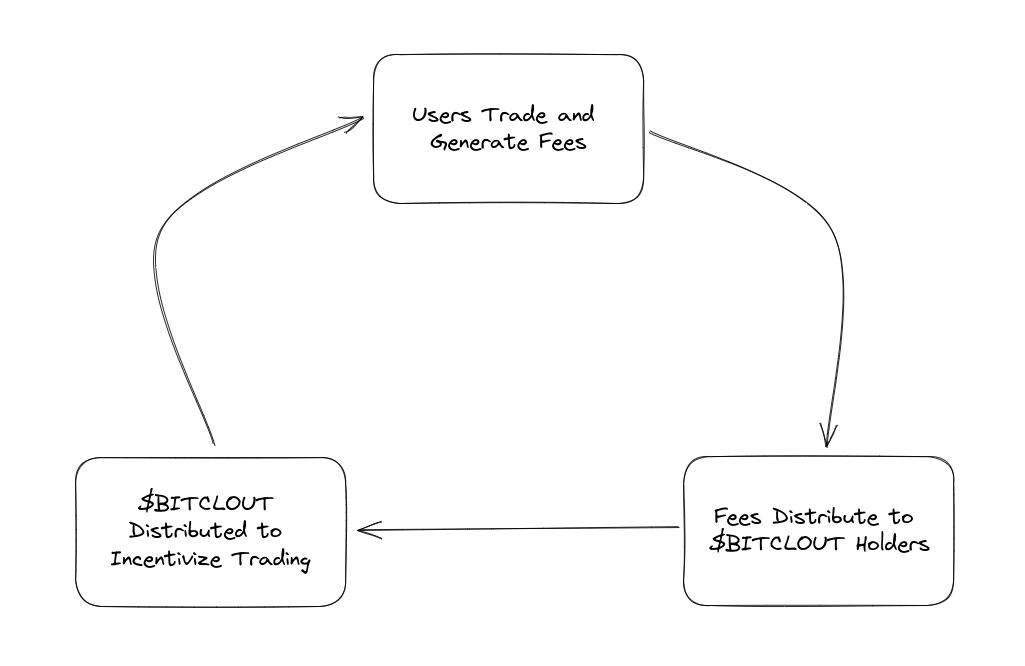

$BITCLOUT will be distributed in various clever ways that we'll describe in order to increase engagement and maximize retention. This will, in turn, increase fees in a virtuous cycle.

A visual representation of this positive feedback loop appears below.

With the above in mind, we can now enumerate all of the things that we want to incentivize with the launch of BitClout 2.0.

Once we have this list, we can then describe the precise mechanisms that we will be using to promote this activity.

Creator Coin Volume. Since $BITCLOUT earns fees as a function of volume, we think it makes sense to make increasing volume a top priority, and to explicitly target it with a long-term sustainable incentive scheme.

Tight Spreads on Creator Coins. Although promoting volume is great, we would also like to encourage traders to submit passive bids and offers that tighten the spreads. Moreover, as we will discuss, this can be done in a way that is arguably much more difficult to game than with volume.

Creator Coin Holding. A major flaw of BitClout 1.0 is that there was no real incentive to hold a Creator Coin, other than to flip it later on. BitClout 2.0 will fix this with a scheme that rewards those who hold the coins of more active creators.

Social Activity. A lot of what made BitClout so magical when it launched was all of the fun content that people were making together. With BitClout 2.0 we want to explicitly incentivize this, as well as incentivize spreading the word on other platforms.

$BITCLOUT Supply and Satoshi Vesting

Interestingly, a finite supply $BITCLOUT coins can be used to establish what we call a perpetual incentive by a new mechanic we introduced in a blog post called Satoshi Vesting.

For example, suppose you want to use 100 million coins to incentivize trading on BitClout 2.0 forever.

You can actually do this by allocating 50 million coins to be given away the first year, then 25 million the second year, then 12.5 million the third year, and so on.

The infinite series will add up to 100 million, thus providing an infinite incentive with a finite supply of coins.

Moreover, if one assumes some amount of appreciation in the value of the coin, then the USD value of the incentive could even increase in spite of the number of coins decreasing.

Given the above, we propose setting the initial supply of $BITCLOUT coins to 1 billion, and then allocating a fixed amount to each incentive category.

As an initial proposal, we present the following split for each incentive, which we'll explain in detail shortly.

1 billion - Total $BITCLOUT Coins (Fixed Supply)

200M Coins - Volume Incentives: 20% of supply to incentivize Creator Coin V2 volume directly via Satoshi Vesting.

200M Coins - Spread Incentives: 20% of supply will be allocated to incentivizing tight spreads via Satoshi Vesting.

150M Coins - Holding incentives: 15% will be distributed to holders of V2 Creator Coins according to some clever criteria to prevent gaming. This will also leverage Satoshi Vesting.

150M Coins - Creator incentives: 15% will be distributed to active creators, as part of promoting social activity, according to some clever criteria to prevent gaming. This will also leverage Satoshi Vesting.

100M Coins - Sell to raise funds: 10% of the supply will be sold via a bonding curve in order to raise funds. This will not leverage Satoshi Vesting, but rather will be distributed directly.

- The benefit of doing a sale like this early on, potentially well before BitClout 2.0 is even launched, is that it also helps to set a price for $BITCLOUT that can then be referenced when distributing coins for incentives without $BITCLOUT necessarily being liquid yet.

200M Coins - Allocated to fund development: 20% of coins will be reserved for the core development team.

Although it is tempting to treat $BITCLOUT as a liquid token on day 1, something we learned from the launch of BitClout 1.0 is that, with a token that is tied to a platform, it can help to have a period during which nobody can trade coins.

During this period, coins could be sold by the platform to raise funds, and coins could be distributed by the platform as incentives, but nobody would be able to transfer or trade the coins they receive until a liquidity event at a later date, say two years from the launch of the platform.

This would ensure that everyone is aligned as the platform is growing, and potentially help with word-of-mouth as well.

With the above categories having been set, and caveats explained, we can now proceed to explain precisely how we will use each category's coin budget to achieve the desired outcome.

Volume and Spread Incentives (With a Posting Requirement)

First off, we will incentivize volume directly by simply distributing $BITCLOUT coins on a daily basis to the top N users sorted by how much volume they traded that day, in proportion to how much volume they produced.

This is a very simple incentive mechanism that is inherently difficult to game because there is a 1% fee charged on each trade.

The number of coins distributed each day will follow Satoshi Vesting such that we distribute X coins per day the first year, then X/2 coins per day the second year, and so on.

Where things get interesting is how we incentivize spreads.

To start, only people who are on the inside of the spread for each coin should be eligible for a reward. In particular, only the users with the highest buy orders and the users with the lowest sell orders for each Creator Coin market should be eligible for a reward.

Once that is established, there then becomes a question of which Creator Coin markets should be eligible for this reward.

The reason this is trickier than it seems at first is because there is nothing stopping someone from creating thousands of fake Creator Coins and making tight spreads on them.

As such, we can apply a simple filter to prevent gaming, which restricts the spread rewards to only the top N Creator Coins by volume. This ensures that those who are making the tight spreads are making them in markets where there is significant risk to gaming the criteria.

For the spread incentives, then, we can distribute a fixed amount of $BITCLOUT coins per day to those who are on the inside of the spread for each of the top N Creator Coins by volume, in proportion to the size of their orders.

The number of coins distributed per day will follow Satoshi Vesting such that we distribute X coins per day the first year, then X/2 coins per day the second year, and so on.

In addition to all of the above, social activity can be promoted by adding the simple requirement that all users need to make a post on the platform in order to be eligible for their rewards on a particular day.

While this will take very little effort on behalf of everyone who's working to earn $BITCLOUT rewards, it has the side-effect of suddenly activating some of the platform's most engaged users from a social activity standpoint.

Creator Incentives (With a Posting Requirement)

While volume is important, we can't forget about creators!

There are many ways to craft an incentive for creators to be active on the platform, but the simplest one seems to be to use a combination of volume and activity.

For example, if we have X $BITCLOUT coins per day to distribute to creators, we can first split these X coins among the top N creators by volume, in proportion to the volume that they generated for the platform.

This aligns creators with working to generate revenue for the platform.

However, as an added twist, we can add the simple condition that, in order for creators to receive their $BITCLOUT rewards for a particular day, they have to make a post. This is not something that is game-able, because ultimately the number of coins is proportional to volume.

However, it would suddenly activate the platform's highest-value users from the standpoint of social activity.

An added incentive can be given if a creator posts to a different platform, perhaps on a less regular basis.

For example, one could make it so that creators are only eligible for their $BITCLOUT rewards if their Twitter and Instagram descriptions link to BitClout.

Holding Incentives (With a Posting Requirement)

In creating an incentive for users to hold a particular creator's coin, we can first consider gating any $BITCLOUT rewards on both a post from the holder having been made that day and a post from the creator whose coin was held being made that day.

This simple incentive would suddenly put a strong emphasis on only holding the coins of creators who are actively posting on the platform.

Moreover, while a creator may not be terribly motivated by earning $BITCLOUT rewards themselves, they might be much more excited about earning $BITCLOUT rewards for all of their fans — and it would only take one post a day!

Now, moving on, suppose we have X $BITCLOUT coins per day to distribute to people who are holding Creator Coins. How should we distribute these coins so as to maximize the incentive to hold Creator Coins?

One naive proposal is simply to distribute $BITCLOUT coins to holders of Creator Coins in proportion to how much is locked up in the AMM for each coin.

So, for example, you could get more $BITCLOUT rewards if you have 1% of a Creator Coin with $1,000 in USD locked in the AMM vs 1% of a Creator Coin with only $100 locked in the AMM. The problem with this is that it doesn't really encourage trading coins that much because people who own a significant percentage of a popular coin will simply sit on their holdings.

Instead, we can get creative and distribute $BITCLOUT rewards to the holders of coins with the highest volume.

This makes the incentive much trickier because you need to try and predict which coin is going to have a lot of volume, and then try to buy a bunch of it before it actually becomes popular.

Additionally, it creates an incentive to move coins around in the event that something becomes less popular, thus potentially producing more turnover than the previous approach.

In any case, whether volume or some other metric is used, the distribution would be similar to the volume and spread incentives.

In particular, X coins per day would be distributed. First an amount would be allocated to each coin, e.g. higher volume coins would get a higher percentage of X than lower-volume coins.

Then, within each coin, the allocation would be split in proportion of that coin's ownership. E.g. if $elonmusk gets 5% of X one day, and you own 10% of those coins, then you would get 10% of 5% of X distributed to you.

Using Incentives to Get Critical Mass

We feel it's important to mention that, when we launched BitClout the first time, we provided virtually zero external incentive for users to engage with it.

Everyone was using the platform and promoting it to their friends, in spite of its flaws, without needing any subsidy.

While this worked well early on, it cannot be understated the effect a token subsidy like what's described previously can have on long-term engagement, especially when applied to a concept that is already inherently engaging.

In particular, many felt that if BitClout could have gotten just a little bit bigger, it would have hit a critical mass, causing even the flawed Creator Coin V1 mechanism to reach a scale at which it was engaging enough to self-sustain.

Whether one believes this or not, it seems clear that, even if token incentives only allow a platform to get a little bit bigger than it normally would, that extra oomph could make all the difference when it comes to retaining users for the long-term. And we've seen this before, as mentioned with Compound, Sushiswap, and Blur.

Decentralizing Social Media

Although we haven't touched too much on the infrastructure that will be powering all of this functionality, it should be noted that BitClout 2.0, and its Creator Coins V2 product, will be launched on the DeSo blockchain.

DeSo's core advantage is that it can support cheap content storage, offering a price of 1/10,000th of a cent to store a "Tweet-sized" piece of content.

In contrast, even modern blockchains like Solana, Polygon, and Avalanche all charge $0.25+ to store the same content, and Ethereum can cost upwards of $80-- just to store an on-chain Tweet!

DeSo supports a native concept of on-chain identity, as can be seen on apps like Diamond, which is essentially a decentralized Twitter.

But DeSo also supports all of the token and NFT functionality needed to power the on-chain order-book exchange referenced previously, as can be seen on apps like Openfund.

The upshot of all of the above is that every single piece of content, and every single asset that is associated with BitClout 2.0 will exist on a fully-decentralized blockchain.

The end result is that, if BitClout 2.0 is successful, it will not only elevate reputation into a new asset class, causing Creator Coins to become the next wave, but it will also push us closer to a future where all of our content is truly owned by us.

A world where all of our content is stored directly on-chain, and controlled solely by our private keys, rather than the world we live in today where five megacorporations control the internet.

BitClout 2.0 will be focused on building a great product for users. But we hope that nobody ever forgets why we're all here in the first place.

The Launch of BitClout 2.0

We see the launch of BitClout 2.0 as analogous in many ways to starting a lawn mower (the gas-powered kind).

You need to make sure that you have a good engine, i.e. a retentive set of core mechanics, and then give it one really big pull as hard as you can.

We feel that everything we've learned from the launch of BitClout 1.0 has gone a long way toward helping us refine "the engine," so to speak.

And now, with added token incentives, inspired by platforms like Blur, we feel like we're also going to get a much bigger pull than we had previously as well.

Ultimately, we can never be sure that something is going to work. We can only be sure that we are learning from past mistakes, and doing our best to improve.

The launch of BitClout 1.0 bombarded us with a lot of criticism, a lot of which came from the media itself.

BitClout 2.0 represents years of deep iteration on feedback from hundreds of people. But, more importantly, it represents a labor of love.

The crafting of a product that we always believed had tremendous potential, but that we didn't get quite right the first time.

And we hope that you'll enjoy using it as much as we enjoy working on it.