Decentralized Reddit

The Reddit Rug-Pull

Recently, almost 96% of Subreddits on Reddit have "gone dark" to protest what is effectively a rug-pull by Reddit leadership. Overnight, Reddit increased its API pricing to exorbitant levels, effectively cutting off highly-popular third-party apps like Apollo, as well as popular moderation tools. Imagine if a centralized entity decided to suddenly set a minimum fee on Bitcoin transactions to $1,000 per transaction unless you used a particular wallet or exchange (something that is impossible on a decentralized network). That is effectively what the Reddit leadership did to its API in an effort to stamp out third-party apps and consolidate all eyeballs onto their own proprietary apps.

However, Reddit relies heavily on volunteer moderators, many of whom relied on third-party apps to perform their duties. And so these moderators decided to effectively stage a strike and turn off the subreddits they manage in protest. If you go to r/funny today, for example, which is a Subreddit with over 40 million members, this is what you see:

While the strike may or may not be successful, it highlights an important lesson: Centralized entities like Reddit will generally move to consolidate power and eyeballs onto their apps, meaning our content isn't really ours-- it's theirs. Much like banks seek to preserve their monopoly on money, social networks seek to preserve their monopoly on content, namely our content.

The solution is to eliminate our reliance on centralized entities for our content the same way we've started to do with money via crypto solutions like Bitcoin. This doc presents a proposal for a decentralized version of Reddit that can both solve the cold-start problem and ensure that our content is truly ours, forever.

From Blur to BitClout: Solving the Cold Start Problem with Coins

Before we go into our Reddit-killer proposal, it is important to note that building a perfect clone of Reddit will never be enough to take market share away from *actual* Reddit. This is because Reddit has a network effect around its content-- users continue using Reddit because all of the content is there, giving Reddit even more content in a vicious cycle.

Luckily, crypto presents a novel way to break centralized network effects known as an "airdrop" or, less forgivingly, a "vampire attack." Essentially, as we will describe, it amounts to creating a coin that you can then give away to new users to incentivize usage when the network is small.

Possibly the best recent example of this is Blur, a now-dominant NFT marketplace. By launching a coin and giving it away strategically to new users, it was able to pull significant market-share away from OpenSea, which was previously a dominant incumbent. Even though OpenSea started with nearly 100% of the NFT market, it now has less market share than Blur!

What's more, some of the most successful DeFi projects in crypto used a coin to bootstrap their projects as well. Compound and Aave are lending platforms that launched with a coin to incentivize providing collateral assets for loans. By giving your collateral to the protocol, you'd earn yield in the form of COMP coins, for example. Similarly, Sushiswap and Uniswap reward users with a coin for providing trading liquidity, and have pledged trading fees back to the coins as well. Perhaps most relevant, though, DeSo itself, the blockchain where this post is published, successfully used a coin to incentivize users to leave Twitter for a new app called BitClout.

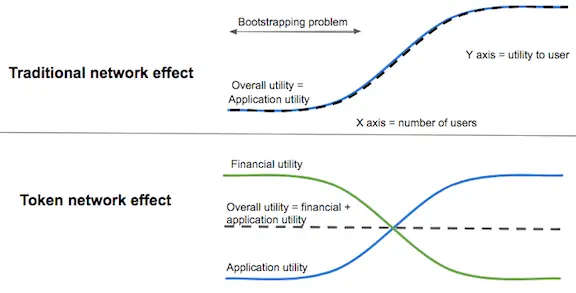

The reason launching a platform with a coin works so well is because a coin can pull forward excitement in the platform, and then this excitement can be used as fuel to subsidize adoption early on, when the platform is small. The following chart from a post by Chris Dixon from a16z illustrates this nicely.

In essence, we want to take the "magic" powering apps like Blur, Sushiswap, and Compound, and apply it to less financialized applications. As such, in what follows, we introduce a new mechanism for using a coin to bootstrap a crypto Reddit competitor.

Forums: Crypto Reddit With Decentralized Ads

Imagine a forum app like Reddit, but everybody gets paid to engage. Creators get paid to post, casual readers get paid when they like posts that are popular, and moderators get paid as well. Let's call this new app simply "Forums."

Reddit’s revenue comes from ads, and Forums can start the same way— but with a crypto twist. Each individual forum, which is like a Subreddit on Reddit, can generate revenue as follows:

- Every week, each forum will automatically auction off an “advertiser NFT.”

- This NFT gives the holder the ability to choose a single post to promote at the top of that particular forum.

- For example, if I own this week’s advertiser NFT for the f/Bitcoin forum, I can select a post promoting my project to sit at the top of that forum for that particular week.

Using NFTs to sell ads means that anyone can participate in the auction of the NFT every week, rather than needing some broker between advertisers and the social platform itself. But, perhaps more importantly, all of the auction mechanics can be implemented entirely on-chain, e.g. via DeSo, providing an auditable and perpetual source of proceeds to a coin.

We can pledge the entire proceeds of the weekly ad auctions to a coin. Let's say we just distribute the proceeds pro rata to coin-holders every time an advertiser NFT is sold (note that pro rata means in proportion to how many coins they have). In doing this, we have now created an asset that we can use to bootstrap usage on the platform, as we will discuss in the next section.

Engage to Earn

Now that we have a token, a natural next question is how do we distribute coins to users to maximize engagement? We want to give users coins in such a way that they are motivated to produce content forever. But we don't want to do this in a way that causes forever inflation in the coins because this would make it hard for someone to value the system.

So what do we do... Luckily, there is a simple solution, which is to "taper" or reduce the number of coins being paid over time in a particular way that results in a capped number of coins. Bitcoin does exactly this: It halves the number of coins that are paid out to miners every four years in order to achieve a long-term fixed supply of 21M coins. This makes sense, especially given that one could reasonably expect the value of a platform to increase over time.

Putting this all together, we can allocate 100M coins to content creators, namely people who post on the platform, and we can distribute this 100M coins as follows:

- Year 1: distribute 50M coins, Year 2: distribute 25M coins, etc... (this series adds up to 100M coins)

- If you post on a particular day, you get a pro rata share of all the coins distributed for that day.

- This means that, initially, users will be getting a lot of coins, similar to how early Bitcoin miners got a lot of Bitcoin, creating a strong incentive to be active ASAP.

To compute the market cap of the coin, then, you just have to multiply the price of a single coin by 100 million. Simple and clean!

Of course we can also allocate coins to other constituents. For example, we could allocate another 10M to moderators, 100M to casual users who like posts on the platform, etc... But in all cases, a perpetual vesting scheme like this can be used to ensure a perpetual incentive for whatever we're trying to get users to do.

Claim Your Profile: The Vampire Attack

In addition to giving users vested coins for posting, engaging, moderating, etc... one can define a one-time reward for joining the platform targeted at a particularly valuable set of users on another platform.

With Forums, it's safe to say that someone who already has a Reddit account is likely more valuable as a user than someone who doesn't. And so you can use your coin warchest to offer an existing Reddit user an added incentive as follows:

- Every user on Reddit can get some number of coins for free if they do the following:

- Create an account on the new platform.

- This can alternatively be described as "claiming" one's account, which users of BitClout will be familiar with. For example, every user of Reddit can have a "ghost profile" pre-created for them on the new platform showing them explicitly how much they stand to gain by joining or "claiming" that profile. This doesn't really change anything about the mechanism, except for the fact that it makes things more share-able. In particular, someone can send you your ghost profile and communicate to you the incentive of joining a bit more easily.

- Make a post on Reddit that you've claimed your account on the new platform.

- This brings even more people over from Reddit in a virtuous cycle. Imagine if, instead of just "blacking out" their Subreddits, mods could redirect people to a forum they control, and get paid for every user they bring over.

This kind of growth hack is sometimes referred to as a vampire attack, and one can study examples by considering LooksRare or SushiSwap, as well as Blur and BitClout.

Using a Fundraise to Test Demand

Suppose you're excited about the Forums idea, but you're not 100% sure if other people will be excited about it. How can you generally know if an idea is solving a real problem for people?

Well, you could talk to a lot of people, but that would take a long time, and it could result in false positives.

Instead, crypto offers a unique way to determine if you're building something worthwhile: Launch a fundraiser for a coin and see how many people buy into your vision.

This not only increases the likelihood that you'll be working on something meaningful, but it also guarantees that you'll have funding to pursue whatever you're building. And if the round is unsuccessful or doesn't raise as much as you'd hoped, you can just refund everyone with a single click. This is the approach adopted by projects like BitClout.

Openfund is a platform that makes this very easy, and fully-reversible for founders. In particular, with just a few clicks you can:

- Create a new coin with a full proposal of what you want to do.

- Open up a funding round for your coin

- Accept contributions with Bitcoin, Ethereum, Solana, USDT, USDC, and DeSo

- If the round is unsuccessful, refund everyone. No harm done

- If the round is successful, you can accept the contributions and open trading of the coin at some point in the future, or never if you prefer (coins are initially not trade-able). You can browse the order-book exchange, which lists a few coins, here.

Liquidity Mining to Test Demand

As an alternative, if you don't want to sell your project's coins, you can start with a softer approach: distribute coins based on having people stake coins to your project temporarily. This is the Compound and Uniswap approach, often called liquidity mining, and it can work as follows:

- Require people to lock some other currency, like Bitcoin, DeSo, or DesoDollar, as collateral in order to receive coins.

- For each hour their collateral is locked, distribute some of your project's coin to them in proportion to how much they've locked.

- The exact economics of this are heavily-adjustable, but you're free to allocate as many coins as you want to this piece. For example, you could allocate 100M coins to a liquidity mining round, while leaving 900M for team and community incentives.

Openfund can also be used to do this nearly out of the box. After creating a profile for your project, you can open a round where users can contribute and withdraw collateral at will. Coins can then be distributed based on who currently has collateral in the round at any given time.

Corporate Airdropping

If you're a founder who's already incorporated, or even gotten venture backing, there's really no reason why you can't still adopt this approach to launching a product like Forums. In fact, while hunting for the elusive product market fit, launching fundraisers for coins associated with each idea could be an efficient validation tool. The coins will just be allocated to the company rather than to an individual, but that's actually a benefit because it can provide a corporate shield for the activities as well.

Anonymous Airdropping

If you're shy about putting your ideas out there, there's no reason why you can't adopt this approach anonymously. Openfund supports a fully-pseudonymous setup, and once you have your fundraise configured, you can simply share it with the groups that you think it would appeal to directly (e.g. on Subreddits, on Twitter, on Diamond, etc...). You can even be your own first contributor and ReTweeter to boost the project's reach without explicitly tying yourself to it.

Anonymous launches are very popular in the NFT community, and so there's good reason to believe that anonymous launches can be successful when coupled with sound long-term-sustainable business models, and possibly a strong demo of an initial product.

The above being said, it is important to note that a project will generally be easier to get support for if one's identity is attached to it. This is also the case with NFT projects; in particular, so-called doxxed teams are generally preferred over anonymous ones.

The Time is Now

Few realize it now, but crypto has the potential to solve both the centralization issues associated with web2 platforms like Reddit and the cold-start problem needed to move people from the old world to the new world. In particular, blockchains like DeSo present not only the tools needed to execute a powerful airdrop, but also the infrastructure needed to store all of the actual content on-chain. The former gives us a path to moving users off of the existing platforms, while the latter ensures that the problems users faced on those platforms can never happen again.

It's never been more important to move users onto decentralized alternatives. But it's also never been easier to actually solve the cold-start problem and do it. All the tools are finally here. What are you waiting for?